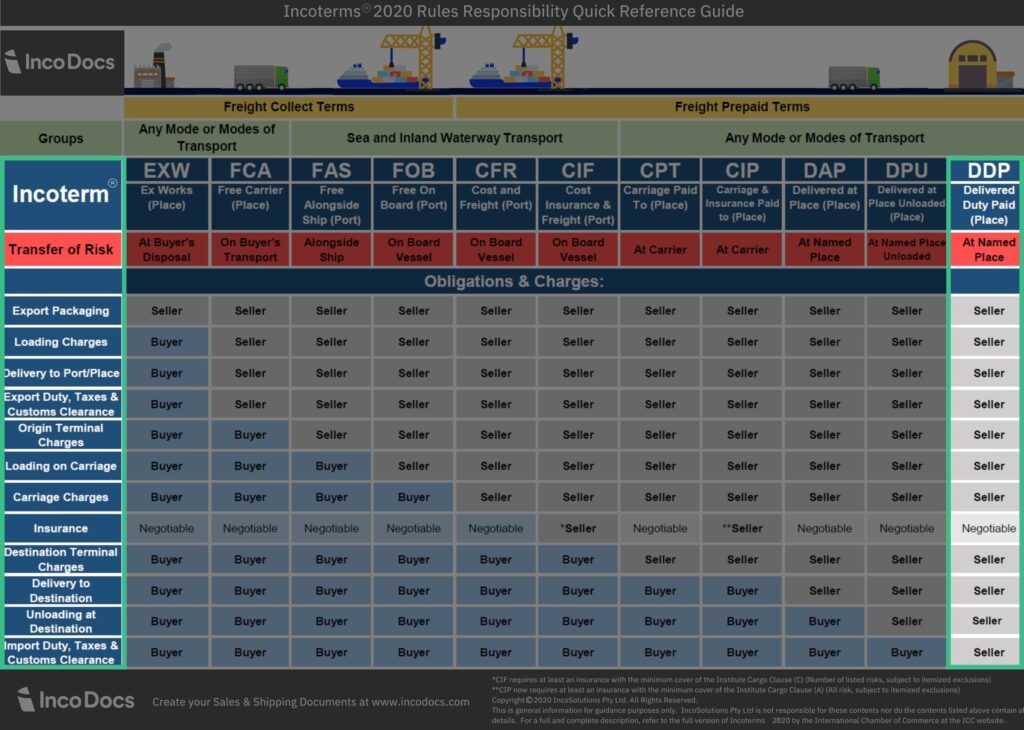

In international trade, understanding shipping terms is crucial. Incoterms, or International Commercial Terms, are standardized rules set by the International Chamber of Commerce (ICC) that define the responsibilities of buyers and sellers. Among these terms, Delivered Duty Paid (DDP) is particularly significant.

What is DDP Shipping?

DDP – is an Incoterm where the seller assumes full responsibility for delivering goods to the buyer’s specified location. This includes covering all transportation costs, export and import duties, taxes, and customs clearance.

Introduced by the ICC in 1967, DDP provides a clear framework where the seller assumes all risks and expenses, ensuring that the buyer receives the goods without any additional responsibilities or costs.

Key Components: Delivery, Duty Paid, and Risk Transfer

Delivery: The seller arranges and pays for the transport of the goods and chooses the mode of transport, which can be by sea, air, or land.

Duty Paid: The seller is responsible for paying all export and import duties. The seller handles all necessary paperwork and formalities to ensure the goods are legally cleared for entry into the buyer’s country.

Risk Transfer: The risk transfer in DDP occurs when the goods are delivered to the buyer at the agreed destination. Until this point, the seller bears all risks, including loss or damage during transit. Once the goods reach the specified location, the risk shifts to the buyer.

Responsibilities Under DDP

Seller’s Responsibilities

Pre-shipment:

- Draw up the sales contract and any related documents required.

- Arrange transportation and pay all transportation costs.

- Handle export packaging and export clearance.

- Ensure all necessary customs documentation is completed.

- Obtain any required export licenses and approvals.

In-transit:

- Pay for all transportation costs, including shipping and domestic freight.

- Cover any insurance if specified in the sales contract.

- Monitor the shipment and handle any issues that arise during transit.

- Keep the buyer informed about the shipment status.

Post-shipment:

- Manage import clearance formalities and pay import duties.

- Obtain approvals from local authorities if needed.

- Pay VAT/GST and any other local taxes.

- Provide proof of delivery to the buyer.

- Cover any additional expenses if the goods are lost or damaged before delivery.

Buyer’s Responsibilities

- Pay for the goods as per the sales contract.

- Arrange and pay for the unloading of goods at the final destination.

- Assist the seller in obtaining any necessary documents for export or import clearance.

Risk Transfer Point

The risk transfer in a DDP shipment occurs when the goods reach the specified destination. The seller bears all risks until the goods are delivered to the agreed location. Once the goods arrive at the named destination, the risk shifts to the buyer. It is important for both parties to clearly agree on the exact location to avoid any confusion about where the risk transfers.

Managing Customs in a DDP Transaction

Customs clearance is critical for DDP transactions. The process begins when goods arrive at destination country. The seller must submit all necessary documents to customs authorities. These documents include Commercial Invoice, Packing List, Bill of Lading, and required permits or licenses. Customs officials review documents to ensure regulations are met. They also inspect goods to verify compliance with local laws.

Each country has its own import rules and requirements. These regulations protect local industries and ensure safety standards. Non-compliance can result in delays, fines, or seizure of goods. It is essential to be well-informed about buyer’s country import regulations. Proper compliance ensures smooth customs clearance and timely delivery.

Advantages of DDP for Buyers

A key advantage of DDP is cost predictability, as all fees are included upfront. This transparency allows buyers to budget effectively and avoid unexpected expenses, simplifying financial planning.

DDP also offers high security and convenience in international trade. It protects buyers from potential risks during shipping and customs clearance, making it especially valuable in business-to-consumer (B2C) transactions where parcels are delivered to door. The comprehensive management of the shipment process makes DDP a preferred choice for many international buyers of small goods.

Disadvantages of DDP for Buyers

One major drawback of DDP is the potential for higher overall costs. While bundling all charges, including shipping, duties, and taxes, offers cost predictability, it can also inflate prices to cover unforeseen expenses. This can make DDP more expensive than other shipping terms where buyers manage some logistics.

DDP also limits the buyer’s control over the shipping process. Since the seller handles transportation and customs procedures, delays may occur if slower or cheaper shipping options are chosen. Buyers have no ability to intervene or expedite the process, which can be problematic when timely delivery is crucial.

Additionally, there is a risk of errors due to unfamiliarity with local customs regulations on the import side. Each country has specific import rules, and any mistakes in following them can lead to delays, fines, or even seizure of goods. Buyers must rely on the seller’s expertise in customs clearance, and errors in this area can cause significant disruptions and additional costs.

When to Use DDP Incoterm

DDP is ideal for stable supply chains with reliable logistics and a solid understanding of the destination country’s customs regulations. It’s particularly effective for high-value industries like electronics, fashion, and luxury goods, where timely delivery and cost predictability are crucial. E-commerce businesses, especially those selling directly to consumers, benefit from DDP’s seamless, door-to-door delivery, making it perfect for B2C transactions and enhancing customer satisfaction.

When Not to Use DDP Incoterm

DDP isn’t always the best option. In countries with high VAT rates, it can be expensive for sellers who must cover these costs upfront. Unpredictable supply chains also present a risk, as sellers may struggle to ensure timely delivery, leading to delays and higher costs. In such cases, buyers may prefer more control over shipping to better manage uncertainties.

Alternatives to DDP, such as Free on Board (FOB) and Cost, Insurance, and Freight (CIF), might be more suitable. FOB lets the buyer take control once the goods are on the shipping vessel, while CIF has the seller cover costs and freight to the destination port, with the buyer handling import duties and further transport. These options can provide more control and potentially lower costs for buyers, especially in complex or high-cost environments.

Difference Between DDP and Other Incoterms

DDP vs. FOB (Free on Board)

With FOB, the seller’s obligation ends once the goods are loaded onto the vessel at the port of origin. The buyer is responsible for arranging and paying for transportation from that point onwards. This includes the cost of freight, insurance, and any other charges incurred during transit. FOB is often preferred when the buyer has reliable logistics partners or wants more control over the shipment process. The buyer also handles customs clearance and pays all import duties and taxes.

DDP differs as the seller is responsible for delivering the goods to the buyer’s location, including all transportation costs and customs clearance.

DDP vs. CIF (Cost, Insurance, and Freight)

Under CIF terms, the seller must arrange and pay for the costs of shipping the goods to the named destination port. This includes the freight charges and insurance coverage during the main transportation leg. However, the buyer is still responsible for import clearance, any additional inland transportation, and associated costs beyond the destination port. CIF is commonly used for maritime shipments where the seller can easily obtain insurance coverage.

Unlike CIF, with DDP, the seller is responsible for all costs, including transportation, insurance, customs clearance, and delivery to the buyer’s location.

DDP vs. DAP (Delivered at Place)

DAP is similar to DDP in that the seller is responsible for arranging and paying for the transportation of goods to the named destination. However, under DAP terms, the seller’s obligation ends once the goods are made available to the buyer at the agreed-upon location. The buyer is then responsible for clearing the goods through customs and paying any applicable import duties or taxes. DAP allows the buyer to have more control over the import process while the seller manages the delivery up to the specified location.

With DDP, the seller’s responsibility extends beyond delivery, as they must also handle customs clearance and pay all import duties and taxes.

Read more about DAP vs DDP vs DPU

Calculating the Landed Cost in DDP Shipping

DDP and landed cost are closely related but not identical. The DDP price includes all costs the seller covers to deliver the goods to the buyer’s specified location, including shipping, insurance, customs duties, and taxes. At this point, the DDP price and landed cost typically align, covering all expenses up to the point of delivery.

However, the difference lies in how post-delivery costs are treated. Some definitions of landed cost include additional charges like unloading fees, while others do not and treat these as separate expenses. If a buyer includes unloading fees in the landed cost calculation, the landed cost would be higher than the DDP price. This is because DDP covers costs only up to the point of delivery, not including the unloading of the goods.

Conclusion on Delivery Duty Paid Incoterm

Delivered Duty Paid (DDP) offers a simple and predictable way to handle international shipping. With DDP, the seller takes care of all the shipping responsibilities, including customs and duties. This makes it easy for buyers, as they don’t have to worry about extra costs or complex procedures. However, DDP can be more expensive and gives buyers less control over the shipping process. It’s important to know when DDP is the best choice and when other Incoterms like FOB or CIF might be better. Choosing the right shipping term helps ensure smooth and efficient trade.