Understanding CIP

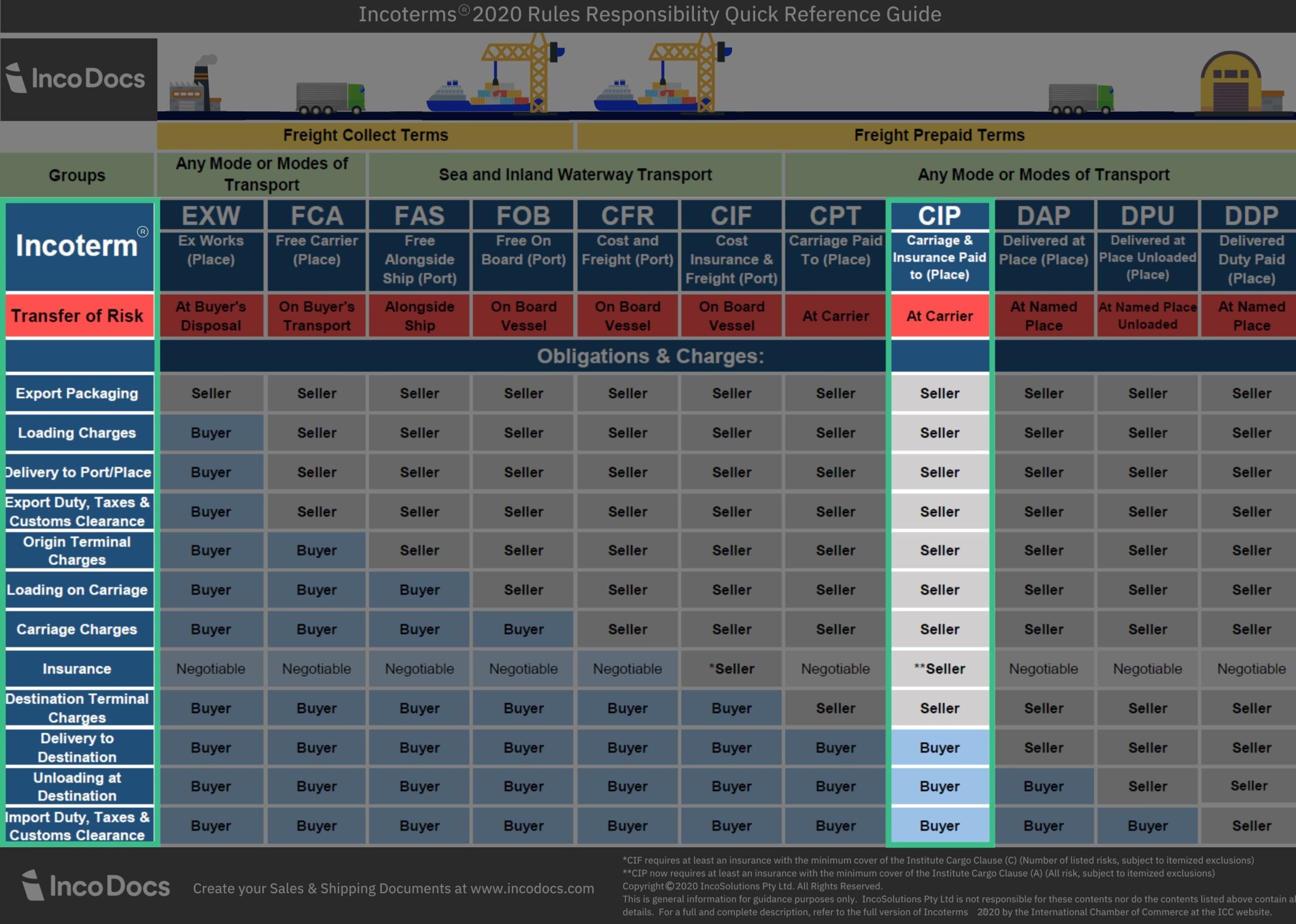

Introduced by the The International Chamber of Commerce (ICC) in 1936, Incoterms are standardized trade terms that define the responsibilities of buyers and sellers in international transactions. CIP, which stands for Carriage and Insurance Paid To, is one such Incoterm. It specifies who is responsible for transportation and insurance coverage until the goods reach a specified destination.

Seller’s Responsibilities Under CIP

When using CIP, the seller has several key responsibilities:

- Transportation: The seller arranges and pays for the cargo to be transported to the agreed destination, covering all main carriage costs.

- Insurance: The seller must obtain insurance on behalf of the buyer, covering at least 110% of the contract value. This ensures the goods are protected during transit. If the buyer believes this coverage is insufficient, they can arrange additional insurance.

- Export Formalities: The seller is responsible for handling all export formalities, including duties, taxes, and customs clearance, ensuring the goods can legally leave the country.

- Risk Transfer: A critical aspect of CIP is that the risk transfers from the seller to the buyer when the goods are delivered to the first carrier. Despite this transfer of risk, the seller continues to cover transportation and insurance costs up to the final destination.

Key Seller Responsibilities:

- Arrange and pay for the main carriage of the cargo.

- Provide insurance during transit.

- Handle export duties, taxes, and customs clearance.

- Ensure goods are delivered to the first carrier on time.

- Notify the buyer of the shipment.

- Provide necessary documentation, such as the commercial invoice.

- Conduct pre-shipment inspection if required.

- Manage export packaging and labeling.

Buyer’s Responsibilities Under CIP

After the goods are transferred to the first carrier, the buyer assumes several responsibilities:

- Risk Management: The buyer takes on the risk of loss or damage to the goods during transit, even though the seller covers the transportation and insurance costs up to the destination.

- Import Formalities: The buyer must handle all import formalities at the destination, including clearing customs, paying any import duties or taxes, and ensuring the goods comply with local regulations.

- Final Transportation: If the goods need to be moved beyond the agreed destination, the buyer must arrange for the final leg of transportation.

Key Buyer Responsibilities:

- Assume risk after the transfer from the seller to the first carrier.

- Handle import duties, taxes, and customs clearance.

- Arrange onward carriage from the destination if needed.

- Check the insurance provided by the seller and consider additional coverage.

- Receive and inspect the goods upon arrival at the destination.

When to Use CIP Shipping Terms

CIP is particularly useful when the goods are high-value and require insurance during transit. It’s also beneficial for shipments involving multi-modal transportation, as it covers various types of carriers throughout the journey.

Benefits of CIP for Sellers and Buyers:

- For Sellers: CIP provides control over shipping and insurance until the goods reach a specified point, reducing the risk of disputes over transportation issues. It also allows sellers to potentially secure better rates through bulk shipping arrangements.

- For Buyers: CIP simplifies the trade process by shifting most logistics responsibilities to the seller. Buyers don’t need to arrange transport or insurance for the main journey, reducing their workload and risk.

Disadvantages of CIP for Sellers and Buyers

- For Sellers: The challenge lies in arranging insurance that meets the buyer’s needs, which could lead to disputes if the coverage is deemed inadequate. Additionally, covering transportation and insurance costs up to the destination can be expensive, particularly in complex logistics scenarios.

- For Buyers: The main drawback is that the risk transfers to the buyer once the goods are handed over to the first carrier. If issues arise during transit and the seller’s insurance falls short, the buyer could face financial losses. Moreover, the buyer has limited control over the choice of carrier and insurance provider.

When Not to Use CIP: Alternatives

While CIP is versatile and widely used, there are situations where other Incoterms might be more appropriate:

- CIP vs. CIF: CIF CIF (Cost, Insurance, and Freight) is better for sea or inland waterway shipments, especially for bulk commodities or lower-value goods. CIF typically offers cost-effective, minimum insurance, making it a specialized choice for ocean freight.

- CIP vs. DAP: DAP (Delivered at Place) differs from CIP in that the seller’s responsibility extends until the goods are delivered to a named place, such as the buyer’s warehouse. DAP is preferable when the buyer wants to avoid handling logistics and risks until the goods are ready for unloading at the final destination.

- CPT vs. CIP: CPT (Carriage Paid To) is similar to CIP but without the seller’s obligation to provide insurance. CPT is better when the buyer prefers to arrange their own insurance, possibly to secure better coverage or negotiate a lower premium.

- FOB vs. CIP: FOB (Free on Board) is primarily used for sea freight, where the seller’s responsibility ends once the goods are loaded onto the vessel. FOB might be more suitable than CIP when the buyer wants full control over the shipping process, including the choice of carrier and insurance.

Changes in CIP in the 2020 Incoterms Update

The ICC updated the Incoterms 2020 rules to reflect changes in global trade practices. One significant change for CIP was the requirement for sellers to provide insurance based on Institute Cargo Clauses (A), which offers more comprehensive coverage compared to the previous requirement of Clauses (C).

Pre-2020: Sellers were only required to insure goods based on Institute Cargo Clauses (C), covering basic risks like fire, explosion, and shipwreck.

Post-2020: The updated Incoterms now require sellers to insure goods under Institute Cargo Clauses (A), which covers a wider range of risks, including theft, damage during loading or unloading, and adverse weather conditions. This change ensures that the buyer’s goods are better protected during transit.

If a buyer requires even more protection, they can negotiate additional insurance with the seller, depending on the value and nature of the goods being shipped.