CIF, or Cost, Insurance, and Freight, is one of the 11 Incoterms defined by the International Chamber of Commerce (ICC). It is used for sea and inland waterway transport. CIF helps make international trade easier by clearly stating who pays for shipping costs and basic insurance. This clarity helps avoid misunderstandings and disputes. CIF ensures that goods have basic insurance during their journey, solving issues related to cost and risk allocation in shipping.

Responsibilities for Sellers and Buyers Under CIF Agreement

Seller’s Responsibilities

Under a CIF agreement, the seller has several key duties:

- Delivery of Goods: The seller must ensure the goods are delivered to the port of shipment.

- Export Clearance: The seller handles all export-related paperwork and ensures the goods clear customs in the exporting country.

- Insurance: The seller arranges and pays for minimum insurance coverage for the goods during transit.

- Freight Charges: The seller pays for the transportation of the cargo to the port of destination.

These responsibilities help ensure that the cargo reach their destination with basic insurance, reducing risks during transit.

Buyer’s Responsibilities

The buyer also has important duties under a CIF agreement:

- Payment for Goods: The buyer must pay for the goods as agreed in the sales contract.

- Import Clearance: The buyer is responsible for all import-related paperwork and customs duties in the destination country.

- Onward Transport: Once the goods reach the named port of destination, the buyer arranges for their transport to the final destination.

These responsibilities start for the buyer once the goods arrive at the port of destination.

When Does Risk Transfer under CIF Incoterm?

Under the CIF (Cost, Insurance, and Freight) Incoterm, it’s important to understand when risk shifts from the seller to the buyer. This point can be confusing because the seller covers the cost of freight, but the actual transfer of risk happens earlier. Here’s a clearer breakdown:

Risk Transfer: The risk moves from the seller to the buyer as soon as the goods are loaded onto the ship at the port of shipment. At this point, the buyer assumes all risks for loss or damage, even though the seller is still responsible for paying freight and arranging insurance up to the destination port.

Cost Responsibility: While the seller pays for the goods, their transport to the destination port, and basic insurance, the risk of loss or damage passes to the buyer at the point of shipment, not when the goods reach their final destination.

The seller provides minimum insurance coverage for the goods during transit, typically covering at least 110% of the invoice value. However, this insurance may not cover all potential risks. Buyers should consider purchasing additional insurance to ensure full protection against unforeseen events after the cargo is loaded.

How CIF Affects Landed Cost

Calculating Landed Cost

Landed cost is the total cost of getting goods from the seller to the buyer’s location, including all expenses up to the destination port. Under CIF (Cost, Insurance, and Freight) terms, this includes the price of the goods, freight charges, insurance, and any other costs incurred during transit. To calculate the landed cost, simply add the CIF price to any additional expenses such as import duties, taxes, and handling fees at the destination port.

Components of Landed Cost Under CIF

The main components of landed cost under CIF are:

- Cost of Goods: The price paid for the goods.

- Freight Charges: The cost of transporting the goods to the destination port.

- Insurance Costs: The expense of insuring the goods during transit.

- Import Duties and Taxes: Charges imposed by the importing country.

- Handling Fees: Costs for unloading and handling the goods at the destination port.

Here’s an example of calculating the landed cost for a shipment using CIF terms:

| Component | Cost |

|---|---|

| Cost of Goods | $10,000 |

| Freight Charges | $1,500 |

| Insurance Costs | $200 |

| ———————– | ——- |

| Total CIF Price | $11,700 |

| Import Duties and Taxes | $800 |

| Handling Fees | $300 |

| Total Landed Cost | $12,800 |

In this example, the CIF price includes the cost of goods, freight charges, and insurance costs. The total landed cost is calculated by adding import duties, taxes, and handling fees to the CIF price. This gives the buyer a clear understanding of the complete expense involved in getting the goods to their location.

Pros and Cons of Using CIF Incoterms

Advantages for Sellers

For sellers, CIF allows greater control over the shipping process. They can select trusted shipping companies and ensure proper handling of their goods. This control can help in managing the shipping schedule and ensuring that the goods are insured adequately during transit.

Disadvantages for Sellers

Using CIF means increased responsibility and costs for the seller. The seller must arrange and pay for the freight and insurance, which adds to their logistical tasks and expenses. This increased responsibility can be a burden, especially for smaller sellers who might not have the resources to manage these tasks efficiently.

Advantages for Buyers

One of the main advantages for buyers using CIF is the ease of handling. Since the seller takes care of shipping and insurance, buyers face less hassle. This also makes costs more predictable, as the CIF price includes shipping and insurance costs. Buyers know upfront what they need to pay for the goods to reach the destination port.

Disadvantages for Buyers

Buyers have limited control over the shipping process. They cannot choose the shipping company or route, which might lead to longer transit times or less efficient shipping methods. Additionally, there may be potential hidden costs not covered in the CIF price, such as local handling fees, which can add unexpected expenses.

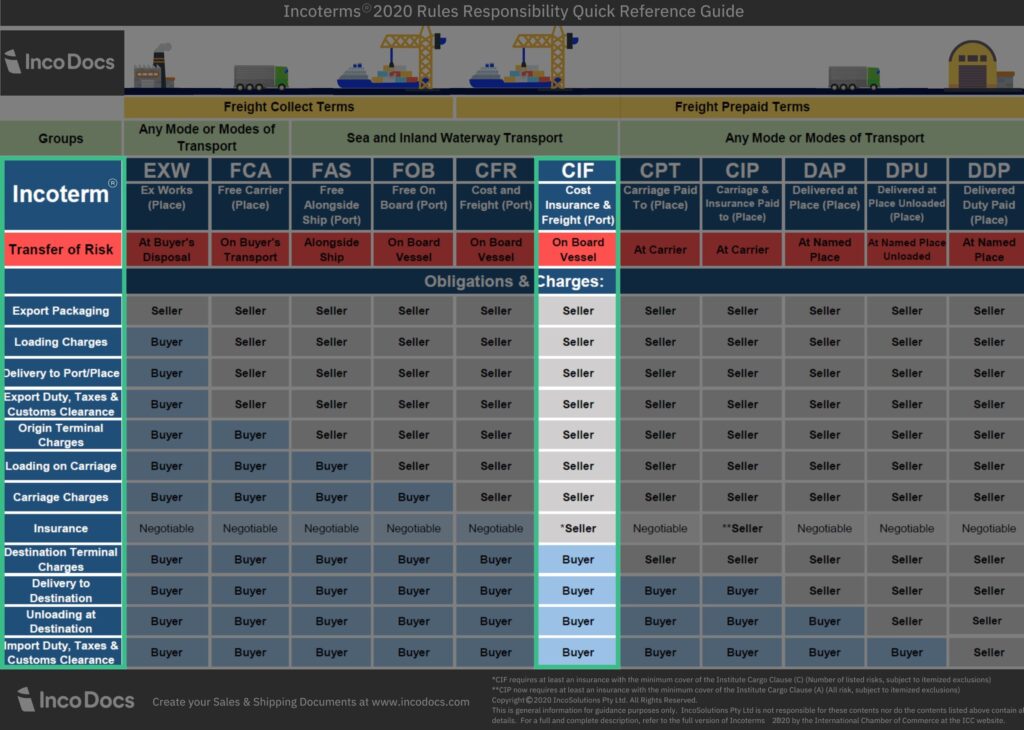

Comparing CIF with Other Incoterms

CIF vs CIP (Carriage and Insurance Paid To)

CIF and CIP are both Incoterms that require the seller to arrange and pay for insurance, but they are used in different contexts and have key differences. CIF is exclusively used for sea and inland waterway transport and cannot be used for air freight. CIP can be used for any mode of transport, including air, rail, and road.

Another difference between CIF and CIP lies in the level of insurance coverage. CIF requires the seller to obtain minimum insurance coverage, typically 110% of the invoice value, which may not cover all potential risks. CIP, however, requires the seller to provide more comprehensive insurance coverage, typically aligned with the Institute Cargo Clauses (A), which offer wider protection.

CIF vs. DDP (Delivered Duty Paid)

CIF and DDP are both Incoterms used in international trade, but they allocate costs and risks very differently.

DDP places the maximum responsibility on the seller. The seller not only covers the cost of goods, freight, and insurance but also handles all import duties, taxes, and delivery to the final destination. The risk remains with the seller until the goods are delivered to the buyer’s premises. This makes DDP a more comprehensive term for buyers, as it reduces their logistical burden and financial risks .

CIF is ideal in scenarios where the buyer wants more control over the final leg of the transportation process. It is also suitable when the buyer has the necessary infrastructure to handle import duties and further transport logistics. CIF is often used for bulk goods and shipments where the buyer has experience with local customs and import procedures.

DDP, on the other hand, is best for buyers who prefer a hassle-free purchasing process. It is ideal when the buyer lacks the infrastructure or experience to handle import formalities and local delivery logistics. DDP is particularly useful for small businesses or first-time importers who benefit from the seller managing all aspects of the delivery process.

CIF vs. FCA (Free Carrier)

CIF and FCA both manage risk transfer differently in international trade. In CIF, risk shifts to the buyer when goods are loaded onto the vessel at the port of shipment. In FCA, risk transfers much earlier. The seller’s role ends once the goods are handed over to the carrier at a specified location, whether it’s the seller’s premises or another agreed point. From this moment, the buyer assumes all risks and costs associated with the carriage.

FCA suits buyers who want more control over the shipping process, especially when multiple transport modes are involved. It’s beneficial for buyers who have specific preferences for logistics providers and who can manage costs and risks from an earlier stage.

CIF vs. DAP (Delivered at Place)

CIF and DAP differ in where the seller’s responsibility ends and where the buyer’s begins. In DAP, the seller’s responsibility extends further. The seller is responsible for all costs and risks associated with delivering the goods to a specified place in the destination country. The buyer takes over only when the goods are ready for unloading at the agreed location

One major advantage of DAP is that it places more responsibility on the seller, who manages the entire shipping process until the goods reach the specified location. This reduces the buyer’s logistical burden, making it easier for the buyer to receive the goods without needing to arrange further transport. This is especially beneficial for buyers who lack the infrastructure or expertise to handle complex logistics.

DAP has its disadvantages: The seller bears all risks and costs up to the point of delivery, including transport, insurance, and other charges until the goods reach the final destination. This can lead to significant expenses for the seller, particularly for smaller sellers who may struggle with these costs.

Any issues or delays during transit are the seller’s responsibility, which can result in longer delivery times if not managed efficiently. The seller must handle any problems during the journey, potentially complicating the shipping process and increasing the time it takes for goods to reach their final destination.

CIF vs. EXW (Ex Works)

CIF and EXW represent opposite ends of the spectrum in terms of seller and buyer responsibilities.

EXW places almost all responsibility on the buyer. The seller’s only duty is to make the goods available at their premises or another named place (factory, warehouse, etc.). The buyer handles all transportation, export duties, insurance, and import clearance from that point onward. Risk transfers to the buyer as soon as the goods are made available for pickup.

EXW is ideal when the buyer has strong logistical capabilities and prefers to control every aspect of the shipping process. It is often used when the buyer has established relationships with freight forwarders and can manage export and import procedures more cost-effectively. EXW is also suitable when goods are sold within the same country or when the buyer has better access to shipping and insurance services

CIF vs. FOB (Free on Board)

CIF and FOB both involve the seller handling initial shipping responsibilities, but they differ in freight, risk transfer and insurance obligations.

FOB requires the seller to deliver the goods on board the vessel at the port of shipment, at which point the freight costs and risk transfers to the buyer. Unlike CIF, FOB does not include insurance charges; the buyer is responsible for obtaining their own insurance from the point of loading onwards.

Conclusion

CIF is one of the most popular shipping terms used in global trade, particularly ocean freight. Its widespread use is due to the clear responsibilities it assigns to sellers and buyers. With CIF, sellers cover shipping and insurance costs to the port of destination. This makes logistics easier for buyers, who benefit from reduced upfront burdens and less complexity.

CIF helps minimize risks and prevent misunderstandings in global trade. By having the seller manage shipping and insurance, CIF reduces the potential for disputes over cost and risk. This built-in risk mitigation, combined with the seller’s duty to arrange insurance, gives buyers a sense of security not always found in other Incoterms.